Table of Contents

Best Construction Insurance Companies – Protecting Your Business so this is a right place we provide you Secure Your Construction Business with the Top 10 Construction Insurance Providers.

Why Construction insurance is Important

Introduction: Safeguarding Your Construction Business

As a construction business owner, ensuring the protection and security of your company is crucial. Construction projects come with various risks and uncertainties, from accidents on-site to property damage. This is where construction insurance comes into play, providing financial protection and peace of mind in the face of unexpected events.In this blog post, we will explore the best construction insurance companies that can help safeguard your business and assets. Let’s delve into the world of construction insurance and discover the top 10 construction insurance providers.

Understanding the Importance of Construction Insurance

Best Construction insurance companies is designed to protect construction businesses from potential risks and liabilities. Whether you are a small contractor or a large construction company, having the right insurance coverage can make a significant difference in mitigating financial losses and legal disputes.From general liability insurance to workers’ compensation and property insurance, there are various types of coverage options available for construction businesses. Choosing the right insurance provider is essential to ensure comprehensive coverage that meets your specific needs and budget

.

Top 10 best Construction Insurance companies list

- ABC Insurance Company: ABC Insurance is known for its extensive experience in providing. Best Construction Insurance Companies

construction insurance solutions tailored to the unique needs of construction businesses. - XYZ Insurance Services: With a focus on customer satisfaction and competitive rates, XYZ

Insurance Services offers a range of insurance products for the construction industry. - ConstructionGuard: ConstructionGuard stands out for its specialized construction insurance

policies and personalized service for clients. - SecureBuild Insurance: SecureBuild Insurance is a trusted name in the construction insurance

industry, offering reliable coverage and support for construction companies. - Builders Assurance: Builders Assurance is a top choice for construction businesses seeking

comprehensive insurance solutions and risk management services. - ShieldSafe Insurance: ShieldSafe Insurance is known for its innovative insurance products and

commitment to protecting construction businesses from potential risks. - SafeSite Insure: SafeSite Insure provides tailored insurance packages designed to address the

specific needs of construction companies while ensuring peace of mind. - ConstructSure: ConstructSure specializes in insuring construction projects of all sizes,

offering comprehensive coverage and exceptional customer service. - ProBuilders Insurance: ProBuilders Insurance is a leading insurance provider for construction

businesses, offering competitive rates and top-notch coverage options. - PrimeConstruct: PrimeConstruct prides itself on delivering reliable insurance solutions and

expert guidance to construction businesses of all types.

Choosing the Best Construction Insurance Company

When selecting a best construction insurance companies to providers for your business, consider factors such as coverage options, pricing, customer service, and reputation in the industry. Conduct thorough research and compare quotes from multiple insurance companies to make an informed decision.Additionally, it is essential to review the terms and conditions of the insurance policy carefully to ensure that you are adequately covered for potential risks. Working with a reputable construction insurance provider that understands the specific needs of your business can provide the protection and security you need to operate with confidence.

Conclusion: Stay Protected and Secure

In conclusion, investing in the right construction insurance policy is essential for the success and longevity of your construction business. By partnering with one of the top construction insurance providers mentioned above, you can protect your business, assets, and employees from unforeseen events and liabilities.Remember, insurance is not just a financial safety net but also a strategic decision to mitigate risks and safeguard your business’s future. Choose the best construction insurance company that aligns with your needs and values to ensure peace of mind and security in the construction industry. Stay protected, stay secure

Also Read – Construction Safety Equipments for Worker’s

What is the meaning of construction insurance?

Construction insurance refers to insurance policies specifically designed to protect construction businesses from risks and liabilities associated with their projects. It provides financial protection against accidents, property damage, third-party claims, and other unforeseen events that can occur during construction activities.

Which insurance is required during construction?

Several types of insurance are essential during construction, including:General Liability Insurance: Covers third-party claims for bodily injury or property damage.Workers’ Compensation Insurance: Provides coverage for employees’ medical expenses and lost wages due to work-related injuries.Contractor’s All Risk (CAR) Insurance: Protects against damage to the construction project, including materials, equipment, and the structure itself.

What is contractor’s all risk insurance policy?

Contractor’s All Risk (CAR) insurance policy is a comprehensive insurance product designed to cover construction projects against various risks, including damage to property, theft, and third-party liability. It typically covers the contractor, subcontractors, and sometimes the project owner.

Why is insurance important in the construction industry?

Insurance is crucial in the construction industry because it helps mitigate financial risks associated with accidents, injuries, property damage, and legal liabilities. It provides peace of mind to construction businesses and ensures they can recover from unexpected events without suffering significant financial losses.

What is the purpose of project insurance?

The purpose of project insurance is to protect all parties involved in a construction project (including owners, contractors, and subcontractors) against risks and liabilities associated with the project. It helps ensure that the project can proceed smoothly and that any unforeseen events do not cause financial distress or delays.

What are the benefits of contractor all risk policy?

The Contractor’s All Risk (CAR) policy offers several benefits, including:Comprehensive Coverage: Protects against a wide range of risks, including damage to the project, materials, equipment, and third-party liability.Financial Protection: Helps cover the cost of repairs or replacements in case of damage or loss during construction.Contractual Requirement: Often required by project owners or stakeholders to mitigate risks associated with construction projects.

!

Check Out Trending Articles

AI, BIM and automation lift pay in construction planning roles

Infrastructure Boom Pushes Civil Engineers’ CTCs Up to ₹25–40 LPA in Mega Projects

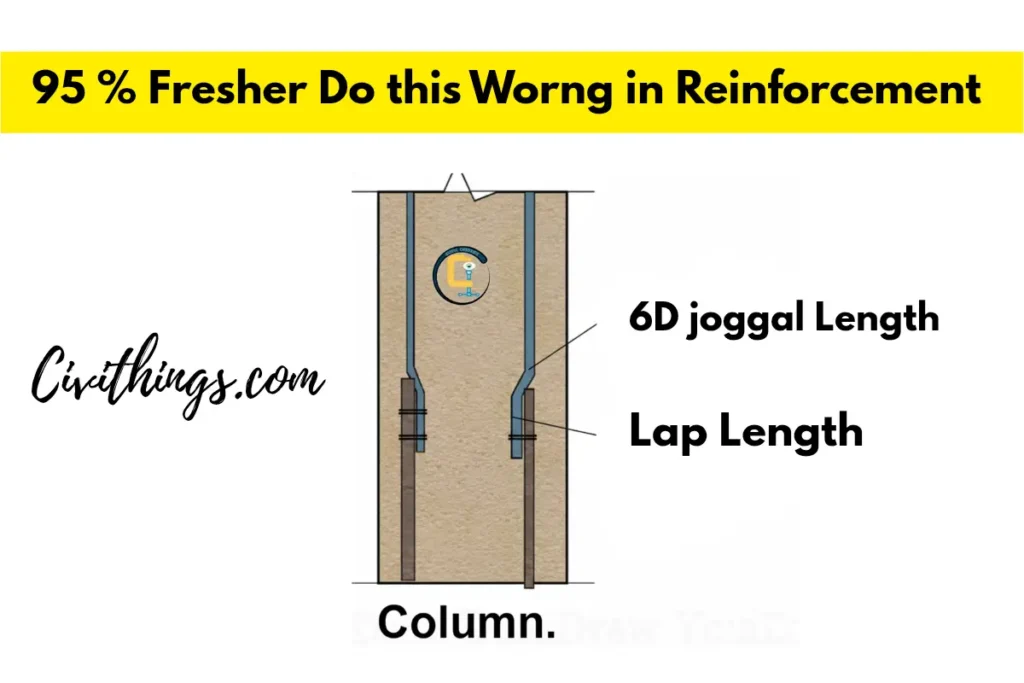

How to Calculate Joggle Bar Length (Step-by-Step Easy Guide for Site Engineers)

Hi! I’m Sandip, a civil engineer who loves sharing about Civil Engineering & new ideas and tips. My blog helps you learn about engineering in a fun and easy way!

For Surety Construction Bonds in NJ or Construction Insurance, call Quantum Insurance Services Quantum is your source for Surety Bonds in New Jersey