Table of Contents

Decline in Housing Completions

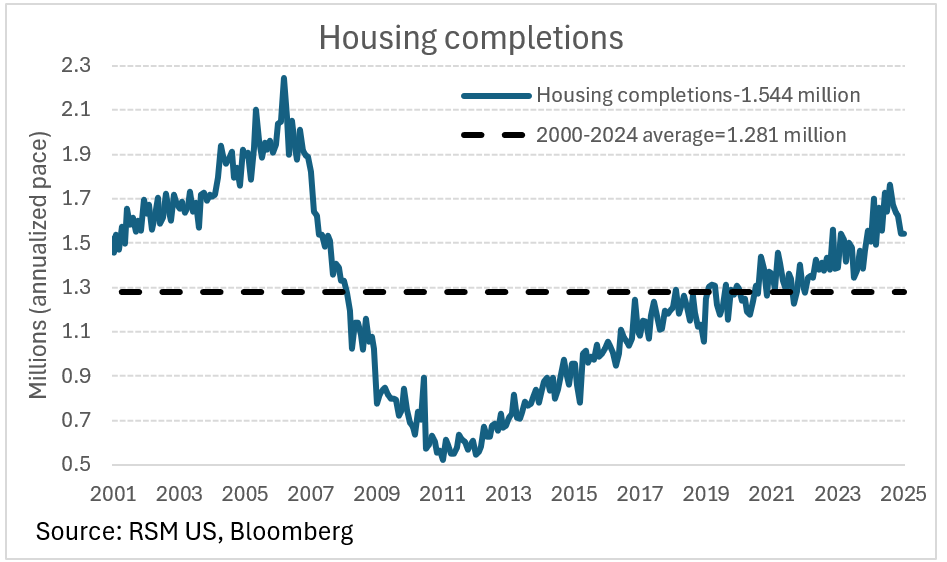

The supply of homes in the U.S. has been struggling to keep up with the growing demand. Recently, housing completions in the country have dropped from a peak of 1.763 million units annually in August to a recent low of 1.544 million units. This decrease is expected to continue, with projections suggesting that the number of homes completed will fall below 1.45 million. As of the end of last year, the number of homes under construction stood at 1.431 million.

The Impact of Housing Completion Shortage

This downward trend in housing completions highlights the ongoing issues within the U.S. housing market. Despite the demand for homes being at an all-time high, the country is facing an inadequate supply of both new and existing homes. This imbalance is becoming a bigger challenge for many prospective homeowners.

Housing Completions vs. Housing Starts

Housing starts, which are often used to gauge economic health, may offer some insight into the bigger picture of U.S. economic trends. However, housing completions provide a clearer view of the difficulties homeowners and buyers are facing today. With so many people looking for homes, the shortage is causing frustration and concern across the market.

Historical Comparison: Housing Completions

When we look at housing completions from a broader historical perspective, they may seem decent. For example, 1.544 million completions is higher than the average of 1.281 million seen over the last quarter-century. However, given the population growth and changing needs of the U.S. housing market, experts suggest that the country needs closer to 2 million housing completions each year to meet demand.

Currently, the U.S. housing market is short by more than 3 million units. This is largely due to the mismatch between the number of homes being built and the number needed to meet the rising demand from people looking for places to live.

Homeowners Reluctant to Sell

A significant factor contributing to the housing supply shortage is the number of homeowners who are reluctant to sell their properties. During the pandemic and in the years before, many homeowners locked in low mortgage rates. Today, nearly 73% of all mortgages have interest rates of 5% or lower, making it less appealing for these homeowners to sell and move to a new property. With mortgage rates climbing higher, many are choosing to stay put, further tightening the available housing supply.

Effects on the U.S. Housing Market

As a result, the housing market is not functioning in a way that can meet the growing demand. Even though there are plenty of people looking to buy homes, the lack of available properties is creating a bottleneck. Builders are struggling to catch up with the demand, and this trend is likely to persist in the coming months.

Broader Economic Implications

This housing supply shortage is not just a challenge for potential buyers but also has broader implications for the U.S. economy. With limited options on the market, prices for homes are rising, making homeownership even less attainable for many. The situation is also affecting renters, as rising home prices and a lack of supply are contributing to higher rental rates.

Conclusion: What’s Next for U.S. Housing?

In conclusion, the housing news in the USA points to a growing issue: a mismatch between the supply of homes and the demand for them. With housing completions falling short of what’s needed, the country is facing a significant shortage that is expected to persist. As mortgage rates remain high and many homeowners stay put, it’s unclear when this imbalance will be resolved. For now, the U.S. housing market is likely to remain a challenging landscape for both buyers and renters.

-

AI, BIM and automation lift pay in construction planning roles

Digital tools are reshaping construction planning and design, pushing up salaries for professionals with AI, BIM and automation skills as firms compete for scarce talent. Introduction Industry reports and recruiter sources are saying that AI, BIM, and automated systems being used in the construction sector has generated increased income opportunities for planning and design specialists.…

-

Infrastructure Boom Pushes Civil Engineers’ CTCs Up to ₹25–40 LPA in Mega Projects

Strong infrastructure growth in India is lifting compensation for senior civil engineers on large-scale projects, while demand outstrips supply. India’s accelerating infrastructure development has strengthened demand for experienced civil engineers, with compensation packages (CTC) for senior roles in major projects reported in the ₹25–40 lakh per annum range in certain cases, driven by a tight…

-

How to Calculate Joggle Bar Length (Step-by-Step Easy Guide for Site Engineers)

In reinforced concrete construction, joggle bars play a very important role, especially in columns, beams, and foundations. Many site engineers, quantity surveyors, and students often get confused about how to calculate joggle bar length correctly. This article explains how to calculate joggle bar length in a simple, practical, and site-friendly way. Whether you are a…

Hi! I’m Sandip, a civil engineer who loves sharing about Civil Engineering & new ideas and tips. My blog helps you learn about engineering in a fun and easy way!